2-24 Advanced Accounting Consolidated Worksheet

The first objective is to demonstrate the effect of different methods of accounting for the investments equity initial value and partial equity on the parent companys trial balance and on the consolidated worksheet subsequent to. Change from cost to equity.

Pdf Chapter 02 Consolidation Of Financial Information 2 1 Chapter 2 Consolidation Of Financial Information 891irc 9htuk7 Academia Edu

Weisman Company a 100 owned subsidiary of Martindale Corporation sells inventory to Martindale at a 20 profit on selling price.

2-24 advanced accounting consolidated worksheet. Dividend receivable at December 31. It shows the individual book values of both companies the necessary adjustments and eliminations and the final consolidated values. After completing this chapter you should be able to.

Discover learning games guided lessons and other interactive activities for children. Consolidation worksheet is a tool used to prepare consolidated financial statements of a parent and its subsidiaries. 2-1 Chapter 2Consolidated Statements.

In accounting for the combination of Merrill Inc. Prior to construction a worksheet the parent prepares a formal allocation of the acquisition date fair value similar to the equity method procedures. This preview shows page 3 - 4 out of 4 pages.

C reduce the dividends payable account by 45000 in the consolidated balance sheet. 800000 640000 160000 Goodwill. You will be creating and entering formulas to complete four worksheets.

Income impact of multiple adjustments resulting from price paid versus book value at date of acquisition. Also use worksheet to derive consolidated totals a. A consolidated working paper entry is necessary to A enter 50000 dividends receivable in the consolidated balance sheet.

Consolidated Information Worksheet December 31 2013 Initial Value Method Consolidation Entries Pecos Suaro Debit Credit Consolidated Total Revenues 1052000 427000 1479000 Operating expenses 821000 262000 50000 1133000 Amortization of intangibles 0 Goodwill impairment loss 0. Attached is an Excel spreadsheet containing the balance sheets and income statements and other trial. Determine which method is used.

Consolidation worksheet entries adjustments and eliminations are entered on the worksheet only. The consolidated paid-in capital amounts are those of the parent company only. Discover learning games guided lessons and other interactive activities for children.

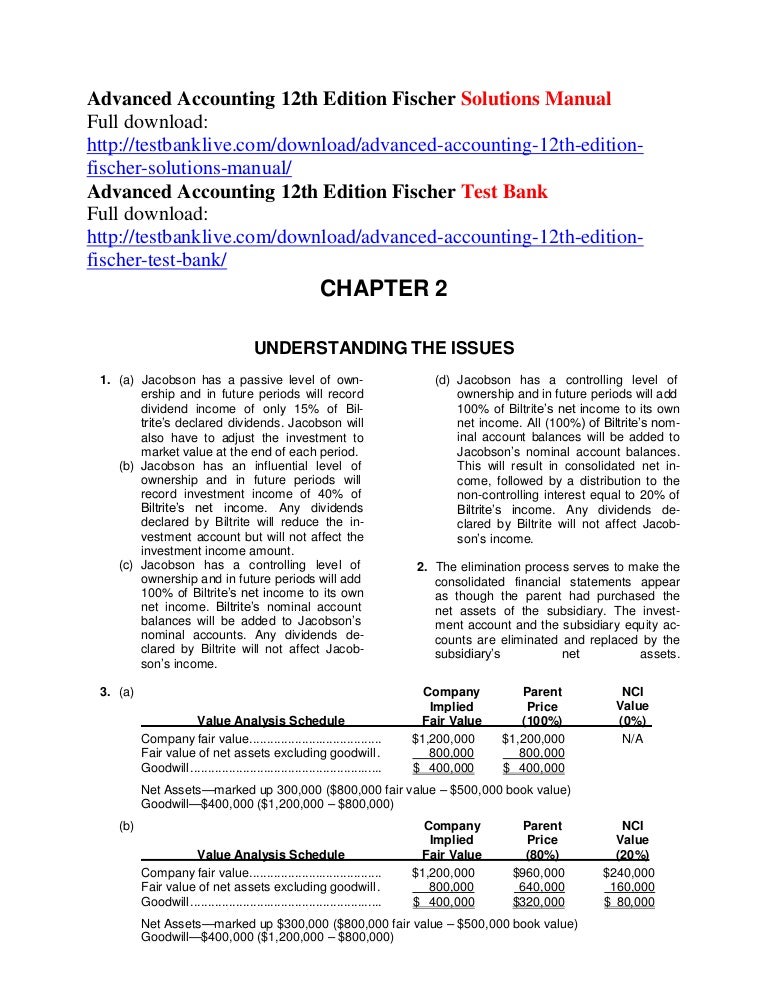

Company Implied Parent Price NCI Value Value Analysis Schedule Fair Value 80 20 Company fair value. Consolidation Worksheet and Equity Method. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Expenses 120000 100000 Net Income 150000 30000 Dividends paid 50000. Want more Accounting Lectures. 400000 320000 80000 Advanced Accounting 12th Edition Fischer Solutions Manual Full.

And Harriss Co the total cost of the acquisition is first determined and then allocated to each identifiable asset and liability acquired with any remaining excess attributed to. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. A simple journal entry consolidation.

Weismans profit numbers were 125000 142000 and 265000 for 2020 2021 and 2022 respectively. 1200000 960000 240000 Fair value of net assets excluding goodwill. Steps in the process.

The following data are available pertaining to inter-company purchases by Martindale. A business combination takes the form of either a statutory merger or a statutory consolidation. Advanced accounting 12th edition fischer solutions manual 1.

45 Minutes Prepare entries for a statutory merger. B enter 45000 dividends receivable in the consolidated balance sheet. The reason for precise identication is explained in Chapter 8 dealing with the eliminations of in- tercompany prots or gains.

Sub- sidiaries paid-in capital amounts always are eliminated in the process of consolidation. Parent buys 100 of target companys assets. Distinguish between the simple equity method and the cost method.

Account Investor Investee Sales 500000 300000 Cost of Goods Sold 230000 170000 Gross Profit 270000 130000 Selling Admin. Date of Acquisition MULTIPLE CHOICE 1. Advanced Accounting 10th Edition Fischer Test Bank.

The advanced accounting principles that will be covered include intercorporate acquisitions and investments including the consolidation and the intercompany accounting.

Advanced Financial Accounting 10th Edition Christensen Solutions Manual By Begrap Issuu

Accounting Principles 12th Edition By Jerry Weygandt Dr Soc

Advanced Accounting Consolidation Business International Financial Reporting Standards

Advanced Accounting 10th Edition Hoyle Solutions Manual By Charde Small Issuu

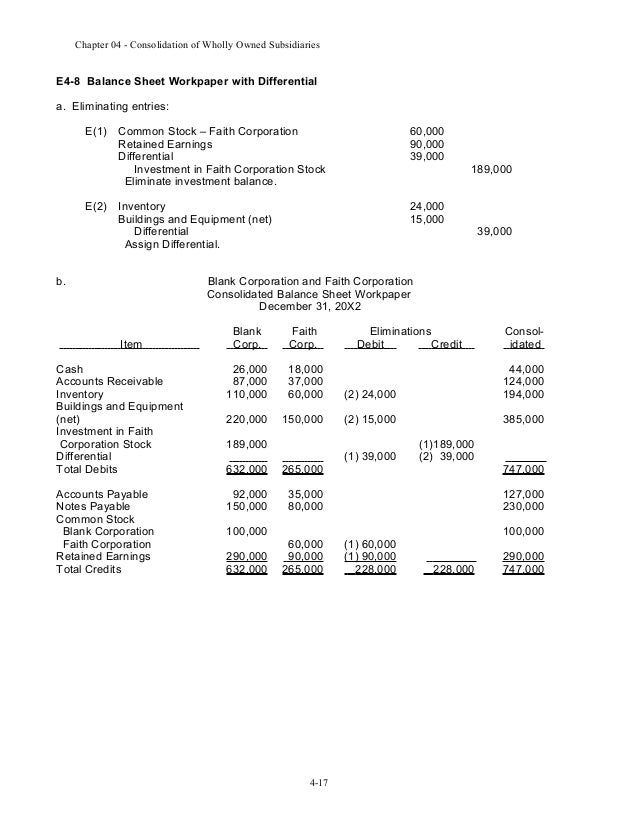

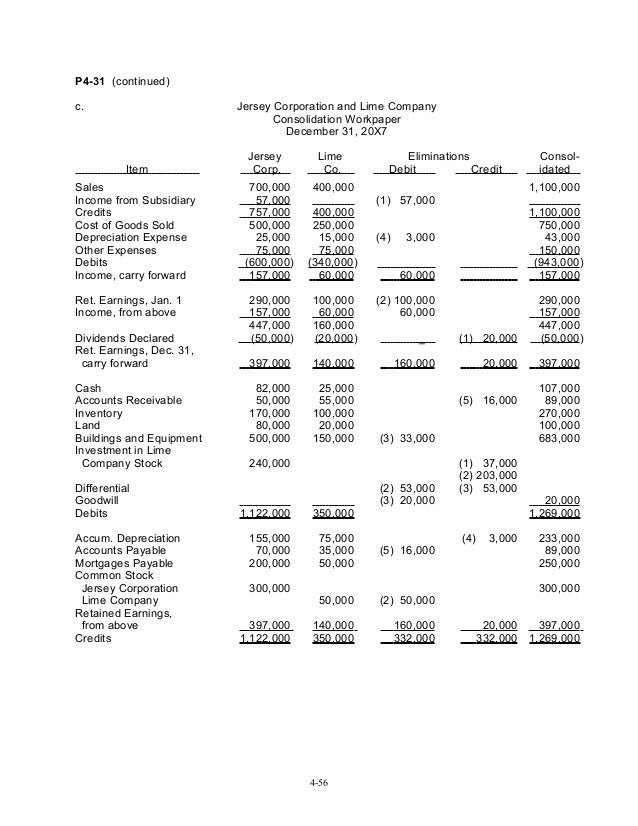

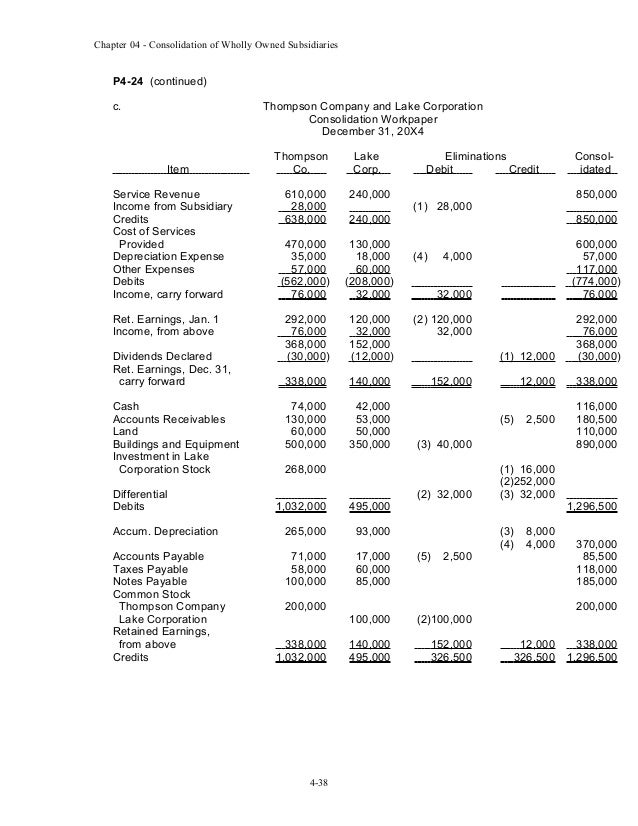

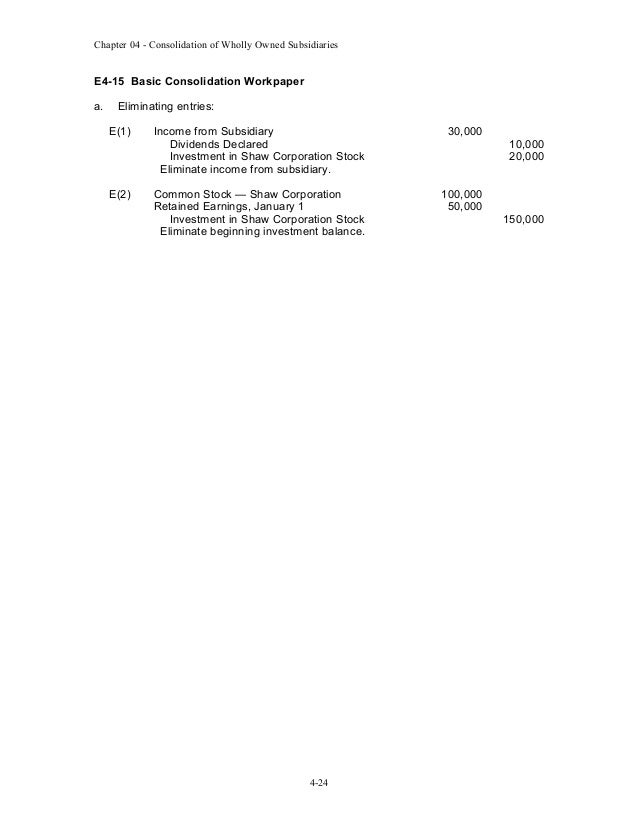

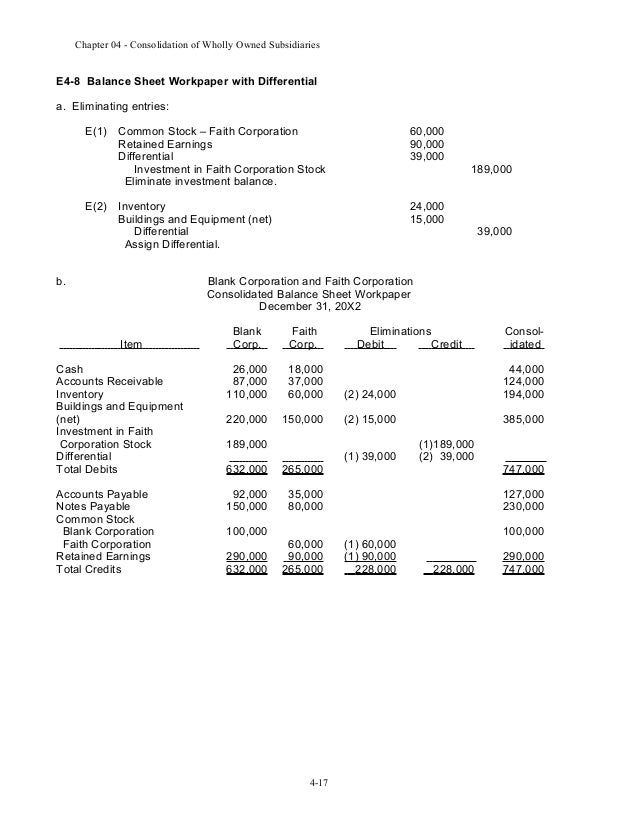

Solusi Manual Advanced Acc Zy Chap004

Advanced Accounting Consolidation Business International Financial Reporting Standards

Financial Reporting Analysis 10e Manual By Charles H Gibbson

Solusi Manual Advanced Acc Zy Chap004

Http Www Smsm Co Id Uploads Attachment Annual 20report 202019 Pt 20ss 20tbk Pdf

Solusi Manual Advanced Acc Zy Chap004

Pin On Hyperpigmentation Treatment

Advanced Accounting 12th Edition Fischer Solutions Manual

Topic 9 Accounting For Income Taxes Financial Accounting

Chapter Two Consolidation Of Financial Information Copyright 2017

Solutions Manual For Advanced Accounting 12th Edition By Fischer By Kris9823128989 Issuu

Solusi Manual Advanced Acc Zy Chap004

Solusi Manual Advanced Acc Zy Chap004

Chapter Two Consolidation Of Financial Information Copyright 2017

Advanced Accounting 12th Edition Fischer Solutions Manual By Create111 Issuu